Not known Details About Pvm Accounting

Not known Details About Pvm Accounting

Blog Article

Little Known Facts About Pvm Accounting.

Table of ContentsWhat Does Pvm Accounting Do?Pvm Accounting for BeginnersSome Known Questions About Pvm Accounting.A Biased View of Pvm AccountingAll about Pvm AccountingThe Single Strategy To Use For Pvm Accounting

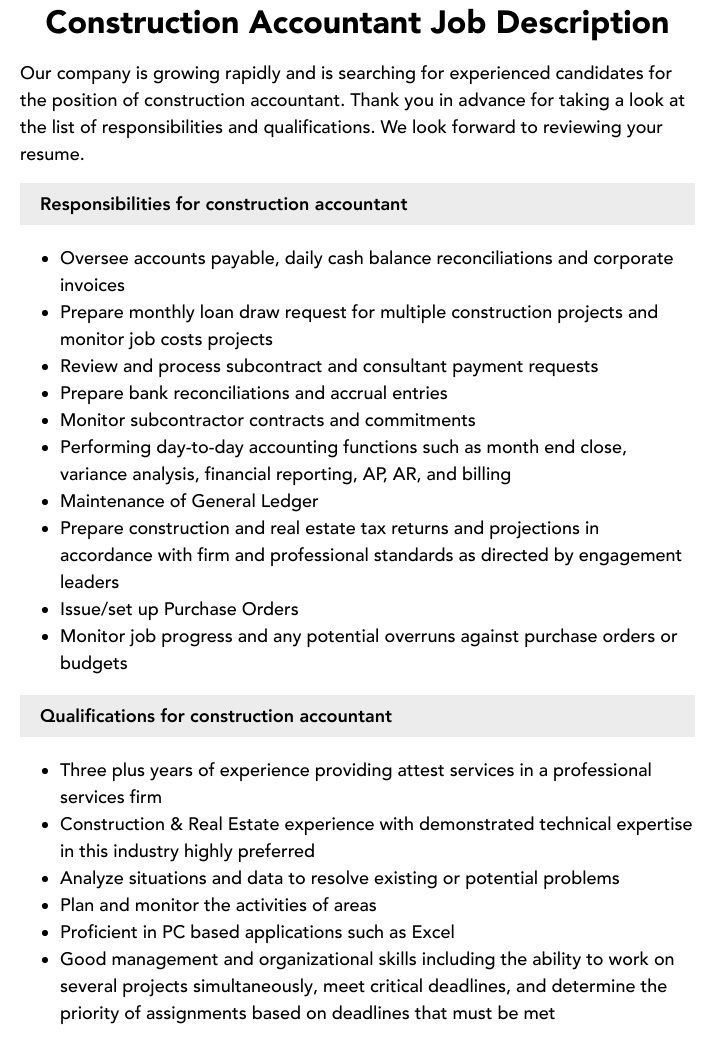

Make sure that the accounting procedure conforms with the legislation. Apply called for building and construction bookkeeping criteria and procedures to the recording and reporting of building and construction task.Connect with numerous funding companies (i.e. Title Business, Escrow Firm) regarding the pay application process and demands needed for repayment. Help with executing and preserving inner economic controls and procedures.

The above statements are intended to describe the general nature and level of work being done by people assigned to this classification. They are not to be interpreted as an exhaustive listing of obligations, tasks, and abilities needed. Workers may be needed to carry out responsibilities outside of their normal duties once in a while, as required.

The smart Trick of Pvm Accounting That Nobody is Discussing

You will certainly help sustain the Accel team to ensure distribution of successful on schedule, on spending plan, jobs. Accel is seeking a Building and construction Accountant for the Chicago Workplace. The Building Accountant does a variety of audit, insurance policy compliance, and task administration. Functions both independently and within details departments to maintain monetary records and make sure that all records are maintained current.

Principal obligations consist of, yet are not restricted to, handling all accounting features of the firm in a prompt and precise fashion and giving records and routines to the business's CPA Firm in the preparation of all financial declarations. Makes certain that all audit treatments and features are handled accurately. In charge of all economic documents, payroll, banking and everyday procedure of the audit feature.

Functions with Task Supervisors to prepare and post all month-to-month billings. Produces regular monthly Job Cost to Date reports and working with PMs to resolve with Job Managers' budget plans for each project.

The smart Trick of Pvm Accounting That Nobody is Discussing

Efficiency in Sage 300 Construction and Realty (formerly Sage Timberline Workplace) and Procore building and construction management software program an and also. https://issuu.com/pvmaccount1ng. Have to additionally be competent in various other computer software application systems for the preparation of records, spreadsheets and other bookkeeping analysis that may be called for by administration. construction accounting. Need to have solid organizational abilities and capability internet to prioritize

They are the economic custodians who guarantee that building tasks remain on budget, abide by tax obligation policies, and maintain economic openness. Construction accounting professionals are not just number crunchers; they are calculated partners in the building procedure. Their primary duty is to handle the economic facets of building projects, making sure that sources are assigned efficiently and monetary risks are reduced.

Pvm Accounting Fundamentals Explained

By keeping a limited hold on project funds, accountants help prevent overspending and economic problems. Budgeting is a cornerstone of effective construction tasks, and building accountants are crucial in this respect.

Construction accountants are skilled in these regulations and ensure that the task complies with all tax demands. To succeed in the role of a building accounting professional, people need a strong academic structure in accounting and financing.

In addition, accreditations such as Qualified Public Accountant (CPA) or Licensed Building And Construction Sector Financial Expert (CCIFP) are extremely related to in the market. Building jobs typically include tight deadlines, changing regulations, and unanticipated expenditures.

An Unbiased View of Pvm Accounting

Ans: Building and construction accounting professionals produce and keep track of budgets, recognizing cost-saving possibilities and guaranteeing that the task remains within budget plan. Ans: Yes, construction accounting professionals take care of tax compliance for building and construction projects.

Intro to Construction Accounting By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Building and construction business need to make tough choices among many economic alternatives, like bidding process on one project over an additional, picking financing for products or devices, or setting a job's profit margin. Building is an infamously volatile market with a high failing rate, sluggish time to settlement, and irregular money flow.

Production includes repeated processes with easily identifiable prices. Production calls for different processes, products, and equipment with varying prices. Each job takes area in a new area with varying website problems and distinct obstacles.

Top Guidelines Of Pvm Accounting

Lasting connections with suppliers reduce negotiations and enhance effectiveness. Irregular. Constant use different specialty contractors and suppliers affects effectiveness and capital. No retainage. Payment arrives completely or with routine settlements for the full contract amount. Retainage. Some portion of repayment may be kept up until job completion even when the specialist's job is completed.

Normal manufacturing and short-term contracts lead to manageable cash money circulation cycles. Irregular. Retainage, slow payments, and high ahead of time expenses result in long, irregular capital cycles - Clean-up bookkeeping. While standard producers have the advantage of regulated atmospheres and optimized manufacturing processes, construction firms have to regularly adapt per new task. Also somewhat repeatable jobs call for adjustments due to website conditions and various other aspects.

Report this page